Advance Child Tax Credit Payments – Coming to a Bank Account or Mailbox Near You

By: Jill Ottley, CPA

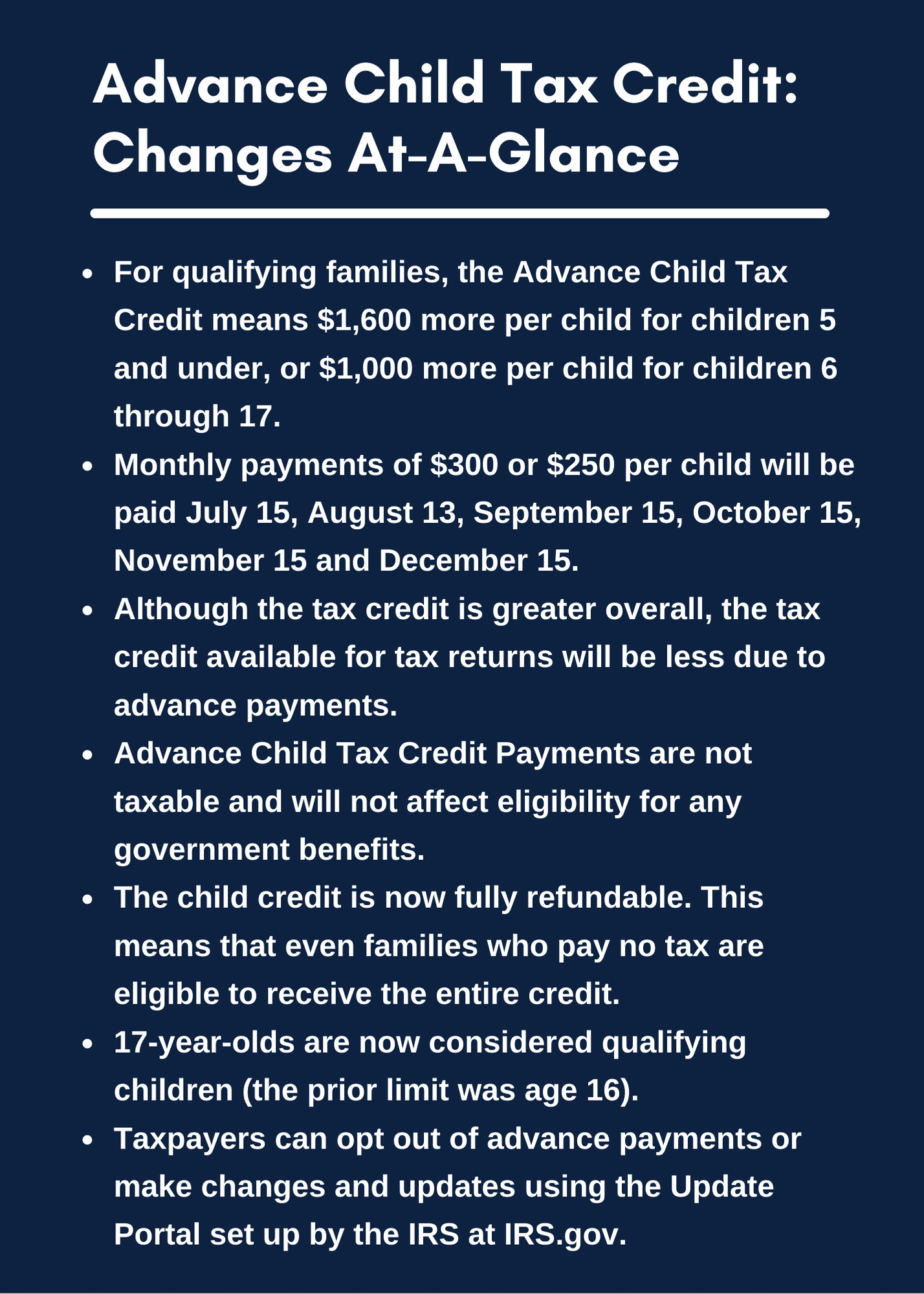

The child tax credit has long offered American families a needed tax break, but it’s never looked quite like this. Beginning July 15, American families will receive bank deposits or checks of up to $300 per child each month. While most families won’t need to take any action to get their payments, some will. Plus, to avoid being caught unawares next April, parents should recognize that these advance child tax credit payments will affect the amount of credit available come tax time. Below is a quick review of what this tax credit entails, who qualifies, how to apply, and more.

Is the new Child Tax Credit more or less than in 2020?

More now, and more overall. Less later.

In recent years, taxpayers have received a credit of $2,000 per qualifying child on their tax returns. The American Rescue Plan Act increases the total amount to $3,600 for children five or younger. Half of that $1,800 will be received via monthly payments of $300 each (6 x $300 = $1,800). That leaves $1,800 left to be taken as a credit on your tax return, or $200 less than available in prior years. For children ages six through 17, the total amount has been increased to $3,000, with $1,500 paid through monthly payments. For them, that leaves only $1,500 remaining to be utilized on tax returns, or $500 less than in prior years.

Do I qualify?

The new maximum credit is available to taxpayers who report $150,000 or less of gross income if they are married and file jointly, or $75,000 or less for singles. The extra amount of credit above the original $2,000 credit phases out rapidly for higher earners.

How does the IRS know where to send payments and who qualifies?

Payments are based on your 2020 tax return, or your 2019 return if you haven’t yet filed for 2020. Did you receive your refund via direct deposit? The IRS will use the same bank account on file to deposit your Advance Child Tax Credit payments. Non-filers can enter their necessary information on IRS.gov (if they haven’t already done so to receive the Economic Impact Payments).

What if I need to make changes?

Do you split custody, or claim children some years and not others? Have a newborn? Do you anticipate significantly different income in 2021 than in 2020? Have you changed bank accounts? Update your information as soon as possible on the Child Tax Credit Update Portal at IRS.gov. (Portal is expected to be live prior to July 15.) Want to opt out of monthly payments and utilize the full Child Tax Credit on your tax return? The Portal is the place to do that, too.