Quick Action Required! Avoid Potential Estate Tax Increases in 2021

Author: James R. Beaudoin, Tax Partner, CPA, PFS, CFP

With just a couple of months until the presidential election, many affluent families are considering whether a change in political power in the Senate and White House might lead to large increases in the Federal estate tax. Many advisors are concerned that changes to the estate tax law could be retroactive to January 1, 2021.

Background

Currently, the United States imposes a 40% tax on estates in excess of a certain exclusion amount. The exclusion amount has varied widely over the past 20 years, from $675,000 in 2001 to $5.49 million in 2017. The Tax Cuts and Jobs Act (TCJA), passed at the end of 2017, doubled the exclusion to $11.18 million, effective in 2018. As indexed for inflation, the exclusion currently sits at $11.58 million for 2020. The doubling of the exclusion by the TCJA is only temporary, halving in 2026. The Democratic Party’s presidential nominee, Joe Biden, hasn’t proposed specific changes to the estate exclusion and tax rate; but he has stated that the TCJA should be repealed for higher-income taxpayers, meaning the doubled exclusion may be cut in half as early as 2021. Some advisors believe if Biden were to take office, he could be pressured to further decrease the exclusion to $3,500,000 and to increase the tax rate to 45%.

Planning Must Begin Now

Waiting for official election results come November 3 will likely make it humanly impossible to implement estate plans. It takes time to reflect on how to transition wealth to one’s family. Estate attorneys will be unable to draft and execute everyone’s estate plans if everyone were to wait until after the election to begin planning. There are many considerations that must go into planning besides reducing the estate tax, e.g., how and when to benefit family members; choosing trustees; choosing the state of trust administration for asset protection and income tax planning objectives; considering multi-generational planning; charitable giving and identifying which assets to gift. Depending upon the amount of wealth married couples have, maybe only one spouse’s exclusion is planned for instead of both spouses’ exclusions. There are several techniques that can be used, including some that enable you to be a beneficiary under your estate plan to protect against the fear of “running out of money.” Some of these techniques require several months to implement. Flexibility in your planning documents is key as estate tax laws are likely to change again many times in the future.

Conclusion

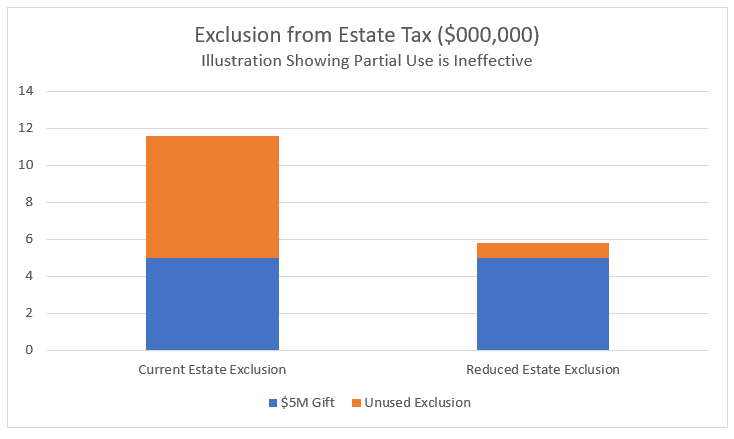

When all is said and done, the exclusion must be used before it is lost, and millions of dollars in estate tax are in play. Gifting only a portion of the exclusion amount is not effective in using the portion of the exclusion that may disappear. See the graph below for an illustration.

Please contact your Squire professional to review your circumstances and to discuss how planning could save your family from potentially much higher Federal estate taxes in the future.