Sales Tax Services

Sales tax compliance shouldn’t be an afterthought. Whether you need a nexus study, ongoing compliance support, or technology solutions, Squire has the expertise to help.

Book A Free Consultation

Connect With Us

Featured Service: Sales Tax Nexus Study

Do You Owe Sales Tax in More States Than You Think?

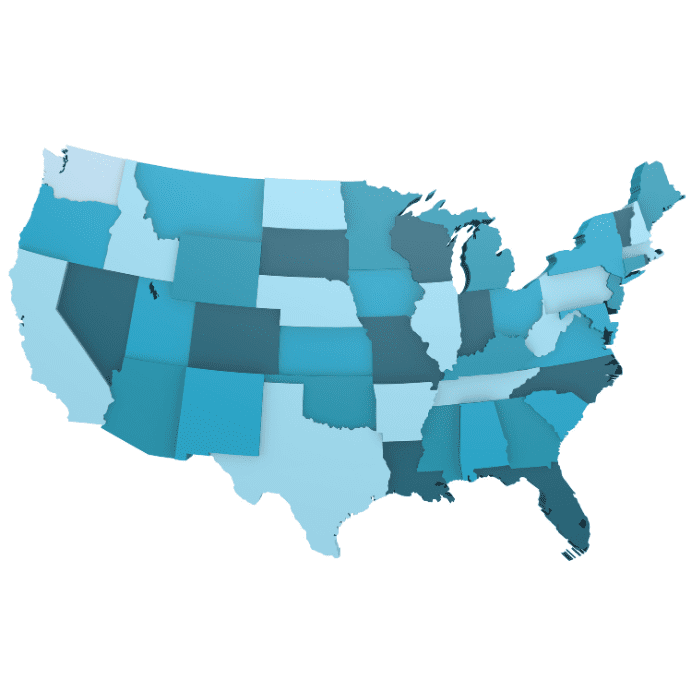

Since the 2018 Wayfair vs. South Dakota U.S. Supreme Court ruling, businesses that sell remotely now face sales tax obligations across multiple states. Expanding sales across 50 states and over twelve thousand local jurisdictions can create a major compliance burden.

A Sales Tax Nexus Study helps you identify where you’re required to register, collect and remit sales tax before audits and penalties arise.

What’s included:

-

Comprehensive Nexus Review

Identify where your business has a legal tax obligation.

-

Risk Assessment & Compliance Strategy

Avoid penalties and unexpected tax bills.

-

Ongoing Tax Guidance

We help you navigate the next steps beyond just reporting. If appropriate, we negotiate voluntary disclosure agreements that can eliminate penalties and limit the look-back period.

Comprehensive Sales Tax Services

Beyond nexus studies, Squire offers end-to-end sales tax solutions to keep your business compliant and efficient.

How We Can Help:

-

Web Store Tax Calculations

Ensure accurate sales tax collection for e-commerce and online sales.

-

Complete Outsourced Solutions

Let our experts handle your sales tax compliance from start to finish.

-

Product Taxability Research & Guidance

Determine which of your products are taxable and in which states.

-

State & Local Registrations

Simplify the process of registering in new jurisdictions.

-

Address-Level Calculations

Ensure precise tax rates for over 12,000+ jurisdictions.

-

Exemption Certificate Management

Avoid compliance issues with properly managed tax-exempt sales.

-

Simplified Month-End Reporting

Reduce the burden on your accounting team with streamlined reporting.

-

Secure Record-Keeping

Stay audit-ready with properly maintained sales tax records.

-

Assistance with Tax Notices & Audits

Get expert guidance in responding to tax authorities.

-

Dedicated Account Manager

Work with a trusted expert who knows your business and its sales tax needs.

Why Sales Tax Compliance Matters

Sales tax laws are constantly evolving, and many businesses don’t realize they have obligations until it’s too late. The risks of non-compliance include:

-

Unexpected Tax Liabilities

States can require years of back taxes, interest, and penalties.

-

Audits & Legal Risks

Failure to comply increases the likelihood of a state audit.

-

Customer Issues

Misapplied sales tax can create disputes and compliance headaches.

Frequently Asked Questions

More questions? Talk to a Sales Tax Expert

-

What is a Sales Tax Nexus Study?

A detailed analysis of where your business is legally required to collect and remit sales tax.

-

How do I know if I need a Nexus Study?

If you sell in multiple states, have remote employees, or work with third-party sellers, you may have tax obligations you’re unaware of.

-

What happens after the study?

We provide a roadmap for compliance, including guidance on registrations, tax collection, and reporting requirements.

Sales Tax Request For Information

Enter your information and a qualified sales tax representative will be in touch soon. *indicates required fields.Sales Tax Service Form

Sales Tax Services "Free Consultation Request Form"